Forex Video of One weeks Double in a Day trading

Sometime it really feels like you

have found the Forex Pot of Gold. Doesn’t it?

Great Double in a Day technique ?

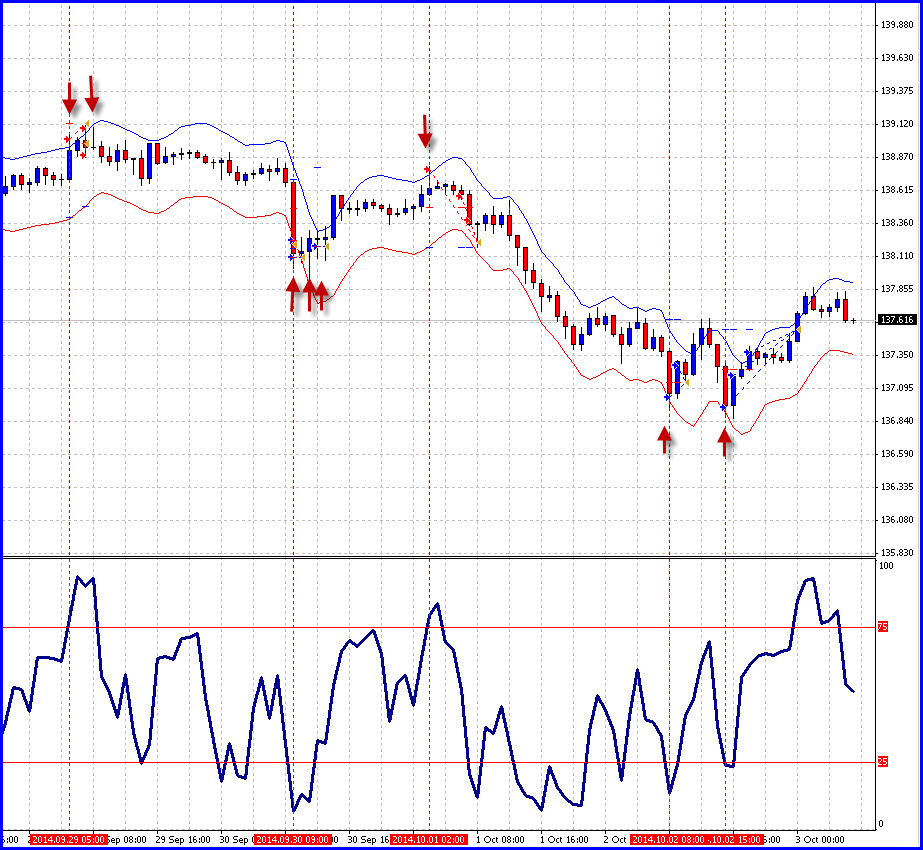

Earlier this week we produced a Double in a Day Forex video showing the use of an RSI system combined with the Envelope indicator to produce really good Double in a Day trades.

http://www.doubleinadayforex.com/free-forex-double-in-a-day-entry-technique/

The video below shows the use of a variation of this technique over a period of a week’s live trading – never shown in this format. Here you can see the negative, breakeven and successful Double in a Day trades when the Double in a Day EA is used in conjunction with a really good Forex entry technique and traded over time. It also shows the amount of patience you need with this technique.

Besides using the envelope technique for Double in a Day trades it is also a great stand-alone simple dynamic channel trading technique.

The rules are very simple –

- when the price touches the envelope lines and

- the RSI is overbought or oversold

- trade the other way

- taking the current trend into account.

The EURJPY 1 Hour chart used in the video

For the DIAD what broker can we use that will not viden spreads under news and are good and reliable and also maybe accept small acounts ?

Best regards

Yes trading is a guessing game with hopefully the odds in favor. If you are not sure about this then just dont place the pending order but wait for the candels to come down watch the screen every 5 minute or if longer timeframe after some candles.

Best regards

Ok yes one maybe must investigate history to see maybe even 70 pips is to mutch ?

Hope we find a way to make this work.

Best regards

If your not watching the charts your guessing. You said and i quote ” I use pending order at price levels where I THINK the price will touch the envelops and when the RSI will be OB or OS (but you can’t be sure that the rsi is OB/OS with out watching the chart right?

To comment on your last comment, i agree. Trading naked on D1 with candle stick formations off S/R zones will have a much bigger stop. To big for the EA, having said that since trading this way, and NOT trading the h1 or lower, my account is up 22.77% for the year.

I will continue to try to use ea for straddles on demo till i find a winning combination. Unfortunately math is not my strong point. Its a lot of hit and miss.

And maybe of my days off i can drop down to h1 and try your ideas.

Thank you Alex and Mary.

no its working as it should. But I think I have to take the the target down to around 70 pips or less. the retrace stops me out a be after topout 1. This is a work in progress.

But using the set file that came with the ea comes with a 100 pip target. NFP on usdjpy don’t seem to be moving that much.

I hope nobody sits around watching the charts. I use pending order at price levels where I think the price will touch the envelopes and when the RSI will be OB or OS. You will go blind and crazy watching the charts all the time. The stops on 4 hour charts are problematic and the actual candles can be tricky – especially the ones covering the open of the UK and US sessions. It might work for ordinary trading with bigger stops. The 15 min charts maybe to short for catching 100 pip runs.

Hi Tomi intresting input, do you have any ideer why the DIAD did not work out for you straddel trading the news, can the problems have been fixed with another broker then the one you have, or was there oteher problems ?

Best regards

I don’t have the time to watch the h1 all day. As anyone tried this “system” on H4 or daily charts.

The DIAD ea works but not on daily charts. The stops are too big for the ea to handle, so I only use it to straddle nfp and a few other news events. My experience with straddles has not worked out. Having said that I’m one of the original beta testers. I have doubled a few demo accounts by getting lucky. Again this was trading the daily time frames, trading pin bars, engulfing candles and such. 19 pip stop normally don’t work out for my style of trading. And yet now that I trade daily I’m making money for the first time.

But the ea works as it should and its a great tool for those who can sit and the trade 15m, I for one can’t do it.

maybe Monday I can do some testing with this rsi on h4 and dailies and post what I get.

Thank you Alex and Mary for a great product(s)

Tomi

Thanks for your feedback

More volatile pairs are better for Double in a Day trading. So trae volatile pairs and don’t trade low volatile pairs – use this link to find currency volatility. http://expert4x.com/forex-currency-volatility-over-a-number-of-weeks/ also this page gives the historic results of 3 currencies tested http://www.doubleinadayforex.com/double-in-a-day-forex-trades-27-sept-14/

Your success with any trading system depends on market conditions – the double in a Day technique will give lots of successes in volatile conditions and fewer in low volatility. The daily ATR indicator is a good guide as to the volatility of a currency

Hi Alex thanks for the great video. would you say this is a normal situation or are there more loses or winners then usual if you would have taken a similar time period ?

Does it matter what pair it is and i would like to know what time frame it is is maybe you have say it ? IS there any pairs that are better then others are the pairs that you dont trade with DIAD ? Thanks Alex and co make some more video it is easier to understand for me and i think for some others as well.

Best regards

Thanks for that question. Bearing in mind that the envelops can repaint until the candle is closed you would need to use your judgement at the time. In general it is better to enter than to wait for the candle to close. Especially if all conditions are met. Always look at other currencies at that time to see which is giving the best trading signals.

This system is not the same as the RSI hook system but very similar.

HI Alex,

Thanks for the informative video.

Just like to understand if the trade is entered once the price touches the envelop in over-sold/over-bought even before the candle closes?

From the previous video, you mentioned about looking for the hook down/hook up of the RSI before entering the trade. Hope to learn more from you. Thanks.